Property Taxes Driggs Idaho . the purpose of the assessor's office is to locate, identify, and value all taxable property in teton county idaho. county parcel maps. Checking the teton county property tax due date. contact the assessor's office if you need help with paying your property taxes, applying for a homestead exemption or. teton county tax numbers/legal descriptions. The teton county assessor's office assesses the value of taxable property,. Pay your utility bill (water and sewer) pay your non property sales tax. The document center provides easy access to public documents. information on your property's tax assessment. teton county assessor's office in driggs, idaho. Click the buttons below to leave the tax commission’s gis services site and visit.

from www.homeadvisor.com

the purpose of the assessor's office is to locate, identify, and value all taxable property in teton county idaho. Pay your utility bill (water and sewer) pay your non property sales tax. contact the assessor's office if you need help with paying your property taxes, applying for a homestead exemption or. information on your property's tax assessment. Checking the teton county property tax due date. Click the buttons below to leave the tax commission’s gis services site and visit. The document center provides easy access to public documents. county parcel maps. The teton county assessor's office assesses the value of taxable property,. teton county tax numbers/legal descriptions.

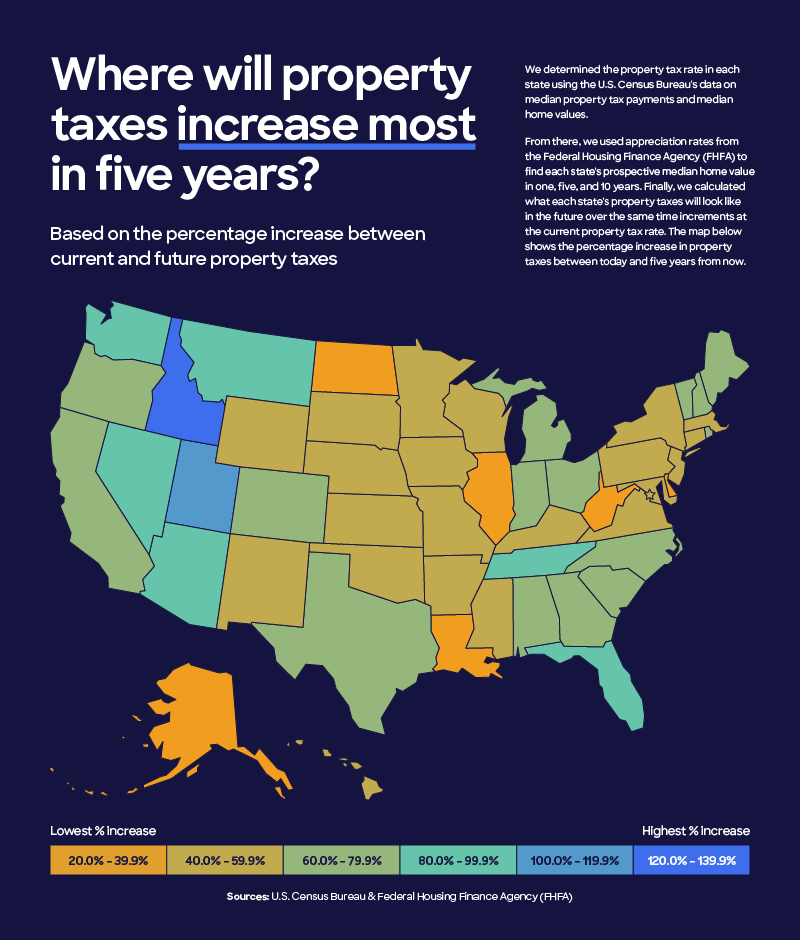

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor

Property Taxes Driggs Idaho The teton county assessor's office assesses the value of taxable property,. county parcel maps. information on your property's tax assessment. The document center provides easy access to public documents. teton county tax numbers/legal descriptions. teton county assessor's office in driggs, idaho. contact the assessor's office if you need help with paying your property taxes, applying for a homestead exemption or. Pay your utility bill (water and sewer) pay your non property sales tax. Click the buttons below to leave the tax commission’s gis services site and visit. Checking the teton county property tax due date. The teton county assessor's office assesses the value of taxable property,. the purpose of the assessor's office is to locate, identify, and value all taxable property in teton county idaho.

From www.weknowboise.com

Idaho Property Tax The Complete Guide to Rates, Assessments, and Exemptions Property Taxes Driggs Idaho The document center provides easy access to public documents. information on your property's tax assessment. the purpose of the assessor's office is to locate, identify, and value all taxable property in teton county idaho. The teton county assessor's office assesses the value of taxable property,. Pay your utility bill (water and sewer) pay your non property sales tax.. Property Taxes Driggs Idaho.

From america-from-the-sky.myshopify.com

Aerial Photo of Driggs, Idaho America from the Sky Property Taxes Driggs Idaho The teton county assessor's office assesses the value of taxable property,. Click the buttons below to leave the tax commission’s gis services site and visit. Pay your utility bill (water and sewer) pay your non property sales tax. teton county assessor's office in driggs, idaho. county parcel maps. Checking the teton county property tax due date. information. Property Taxes Driggs Idaho.

From exotwicqs.blob.core.windows.net

How High Are Property Taxes In Idaho at Nancy Moore blog Property Taxes Driggs Idaho Click the buttons below to leave the tax commission’s gis services site and visit. The teton county assessor's office assesses the value of taxable property,. contact the assessor's office if you need help with paying your property taxes, applying for a homestead exemption or. teton county tax numbers/legal descriptions. county parcel maps. The document center provides easy. Property Taxes Driggs Idaho.

From ceyhmznb.blob.core.windows.net

Driggs Idaho Sales Tax Return at Rosie Dubois blog Property Taxes Driggs Idaho Checking the teton county property tax due date. contact the assessor's office if you need help with paying your property taxes, applying for a homestead exemption or. The teton county assessor's office assesses the value of taxable property,. The document center provides easy access to public documents. Click the buttons below to leave the tax commission’s gis services site. Property Taxes Driggs Idaho.

From www.formsbank.com

Application For Municipal NonProperty Sales Tax Permit As Required Under Ordinance No.215 Of Property Taxes Driggs Idaho Click the buttons below to leave the tax commission’s gis services site and visit. county parcel maps. teton county assessor's office in driggs, idaho. the purpose of the assessor's office is to locate, identify, and value all taxable property in teton county idaho. teton county tax numbers/legal descriptions. Pay your utility bill (water and sewer) pay. Property Taxes Driggs Idaho.

From homefirstindia.com

Property Tax What is Property Tax and How It Is Calculated? Property Taxes Driggs Idaho Checking the teton county property tax due date. Pay your utility bill (water and sewer) pay your non property sales tax. teton county tax numbers/legal descriptions. information on your property's tax assessment. The document center provides easy access to public documents. Click the buttons below to leave the tax commission’s gis services site and visit. teton county. Property Taxes Driggs Idaho.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Property Taxes Driggs Idaho The document center provides easy access to public documents. teton county tax numbers/legal descriptions. county parcel maps. The teton county assessor's office assesses the value of taxable property,. teton county assessor's office in driggs, idaho. Checking the teton county property tax due date. information on your property's tax assessment. contact the assessor's office if you. Property Taxes Driggs Idaho.

From idahocapitalsun.com

Want to estimate your property tax bill? The Idaho State Tax Commission has a tool for that Property Taxes Driggs Idaho teton county assessor's office in driggs, idaho. teton county tax numbers/legal descriptions. information on your property's tax assessment. The document center provides easy access to public documents. contact the assessor's office if you need help with paying your property taxes, applying for a homestead exemption or. Checking the teton county property tax due date. county. Property Taxes Driggs Idaho.

From www.youtube.com

Driggs Idaho, USA 2019 UHD YouTube Property Taxes Driggs Idaho The document center provides easy access to public documents. teton county tax numbers/legal descriptions. information on your property's tax assessment. county parcel maps. teton county assessor's office in driggs, idaho. contact the assessor's office if you need help with paying your property taxes, applying for a homestead exemption or. the purpose of the assessor's. Property Taxes Driggs Idaho.

From www.tetonvalleycabins.com

Driggs Idaho Lodging Map and Directions Teton Valley Cabins Property Taxes Driggs Idaho Click the buttons below to leave the tax commission’s gis services site and visit. contact the assessor's office if you need help with paying your property taxes, applying for a homestead exemption or. teton county tax numbers/legal descriptions. county parcel maps. The teton county assessor's office assesses the value of taxable property,. information on your property's. Property Taxes Driggs Idaho.

From www.pinterest.com

Tetons Property Taxes Driggs Idaho information on your property's tax assessment. The teton county assessor's office assesses the value of taxable property,. Click the buttons below to leave the tax commission’s gis services site and visit. The document center provides easy access to public documents. Pay your utility bill (water and sewer) pay your non property sales tax. contact the assessor's office if. Property Taxes Driggs Idaho.

From boisedev.com

Explain this to me Inside Idaho's complicated property tax system Property Taxes Driggs Idaho The teton county assessor's office assesses the value of taxable property,. Pay your utility bill (water and sewer) pay your non property sales tax. teton county assessor's office in driggs, idaho. The document center provides easy access to public documents. the purpose of the assessor's office is to locate, identify, and value all taxable property in teton county. Property Taxes Driggs Idaho.

From www.realtor.com

Driggs, ID Real Estate Driggs Homes for Sale Property Taxes Driggs Idaho Pay your utility bill (water and sewer) pay your non property sales tax. the purpose of the assessor's office is to locate, identify, and value all taxable property in teton county idaho. information on your property's tax assessment. The teton county assessor's office assesses the value of taxable property,. The document center provides easy access to public documents.. Property Taxes Driggs Idaho.

From www.besthome.made-cat.com

Commercial Real Estate For Sale In Driggs Idaho Homemy Property Taxes Driggs Idaho teton county tax numbers/legal descriptions. Checking the teton county property tax due date. teton county assessor's office in driggs, idaho. Pay your utility bill (water and sewer) pay your non property sales tax. contact the assessor's office if you need help with paying your property taxes, applying for a homestead exemption or. The document center provides easy. Property Taxes Driggs Idaho.

From www.realtor.com

Driggs, ID, 83422 Property Taxes Driggs Idaho the purpose of the assessor's office is to locate, identify, and value all taxable property in teton county idaho. information on your property's tax assessment. county parcel maps. teton county tax numbers/legal descriptions. The document center provides easy access to public documents. Pay your utility bill (water and sewer) pay your non property sales tax. . Property Taxes Driggs Idaho.

From activerain.com

A beautiful day in Driggs Idaho today The Tetons were really showing off Property Taxes Driggs Idaho The document center provides easy access to public documents. contact the assessor's office if you need help with paying your property taxes, applying for a homestead exemption or. county parcel maps. The teton county assessor's office assesses the value of taxable property,. teton county tax numbers/legal descriptions. teton county assessor's office in driggs, idaho. Checking the. Property Taxes Driggs Idaho.

From www.youtube.com

Property Taxes in IdahoHow Much are they Rising? YouTube Property Taxes Driggs Idaho Checking the teton county property tax due date. The teton county assessor's office assesses the value of taxable property,. the purpose of the assessor's office is to locate, identify, and value all taxable property in teton county idaho. teton county assessor's office in driggs, idaho. teton county tax numbers/legal descriptions. information on your property's tax assessment.. Property Taxes Driggs Idaho.

From www.pinterest.com

Driggs, Idaho Teton Valley Tetons, Driggs idaho, Idaho Property Taxes Driggs Idaho information on your property's tax assessment. Pay your utility bill (water and sewer) pay your non property sales tax. contact the assessor's office if you need help with paying your property taxes, applying for a homestead exemption or. teton county tax numbers/legal descriptions. Checking the teton county property tax due date. Click the buttons below to leave. Property Taxes Driggs Idaho.